In the ever-evolving landscape of international trade, safeguarding B2B Accounts Receivable is of paramount importance. Companies involved in cross-border transactions face the constant challenge of managing bad debts, which can significantly impact their financial stability. This thesis explores how Debt Collectors International (DCI), a renowned collection agency, plays a pivotal role in preserving the value of a B2B company’s Accounts Receivable Portfolio within the International Corporate Marketplace. We will focus on the Electronics Manufacturing industry in the context of trade between the U.S.A. and South Korea.

The Integral Role of International Trade

International Trade: A Cornerstone of the B2B Sector

In today’s globalized world, international trade has become an integral component of the B2B sector. The exchange of goods and services across international borders is no longer an option but a necessity for businesses worldwide. The trade relationship between the U.S.A. and South Korea exemplifies this integration.

Electronics Manufacturing: Powering Global Innovation

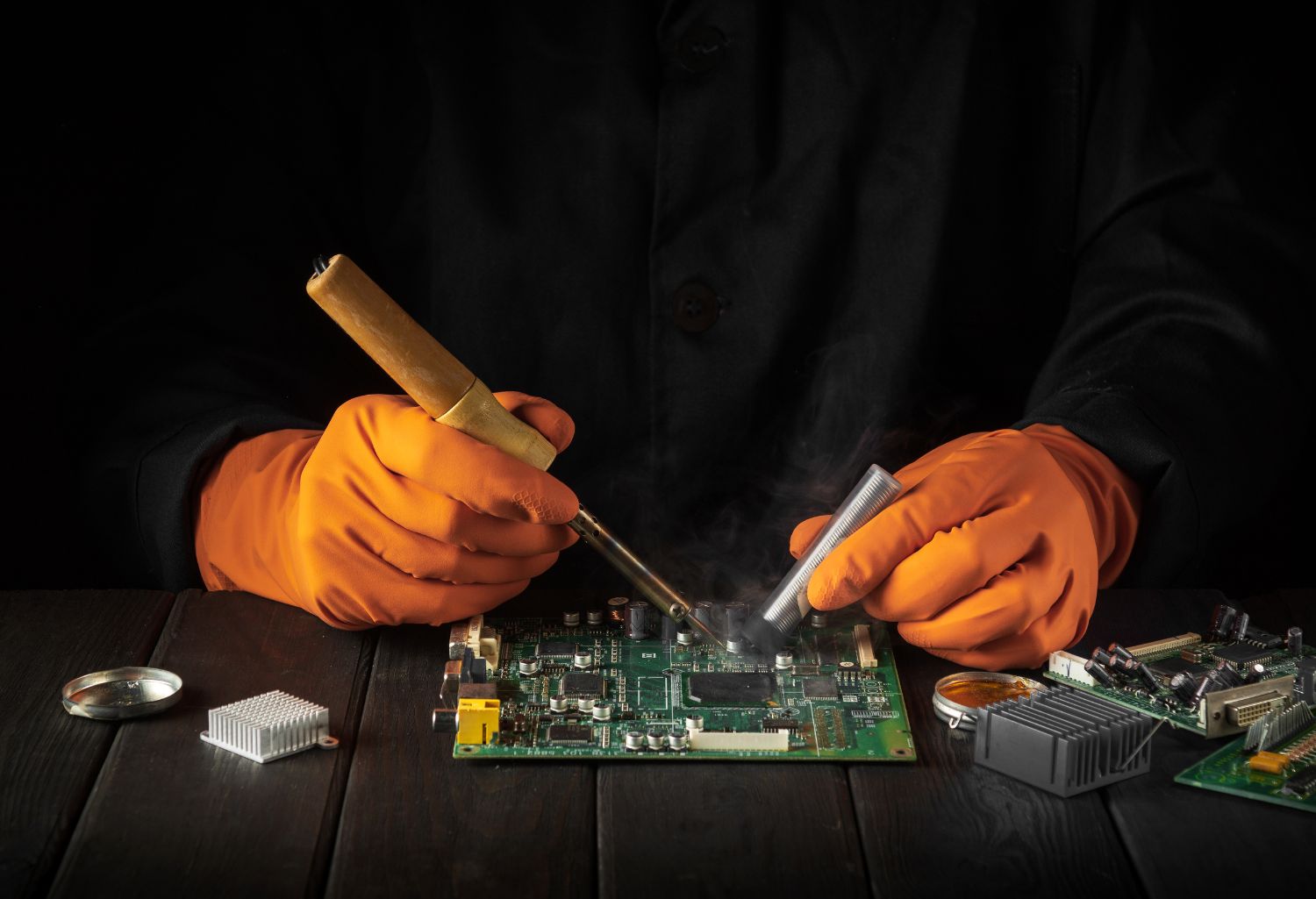

Understanding Electronics Manufacturing

The Electronics Manufacturing industry encompasses the production of electronic devices and components, including consumer electronics, semiconductors, and electronic equipment for global markets. This sector is a driving force behind technological innovation and global commerce.

Challenges of Bad Debts

Addressing Bad Debts in International Trade

Despite the opportunities presented by international trade, managing bad debts remains a critical challenge for businesses. Several areas of concern arise when dealing with past-due debts within the U.S.A. and South Korea International Trade Industry:

1. Legal Complexity Across Borders

Navigating Cross-Border Legal Challenges

International debt recovery involves navigating a complex web of legal intricacies. Recovering debts across different legal systems and jurisdictions requires specialized knowledge and expertise.

2. Language and Cultural Barriers

Overcoming Communication Challenges

Language and cultural differences can create substantial barriers when communicating with debtors. Effective negotiation and resolution necessitate a deep understanding of cultural norms and linguistic nuances.

3. Regulatory Compliance

Adhering to Diverse Regulations

International debt collection demands strict compliance with various regulations and legal standards. Failing to do so can lead to legal complications that businesses prefer to avoid.

4. Timely Debt Recovery

Maintaining Financial Stability

Timely debt recovery is essential for maintaining financial stability. Delays in recovering funds can disrupt cash flow and hinder business operations.

5. Cost-Efficiency

Minimizing Losses

Cost-efficient debt collection services are crucial for businesses looking to minimize losses related to bad debts. Inefficient processes can exacerbate financial challenges.

DCI’s Efficient Debt Recovery System: Debt Recovery in Electronics Manufacturing

DCI’s Proven Approach

DCI offers a comprehensive three-phase debt recovery system designed to efficiently recover company funds:

Phase One: Initial Contact and Investigation

Within 24 hours of placing an account, DCI initiates the debt recovery process, including:

- Sending the first of four letters to the debtor via US Mail.

- Conducting skip tracing and investigations to obtain the best financial and contact information available on the debtors.

- Initiating contact with the debtor using a variety of communication methods, including phone calls, emails, text messages, faxes, and more.

- Daily attempts to contact the debtor for the first 30 to 60 days.

Phase Two: Legal Expertise

If Phase One attempts fail, DCI leverages its network of local attorneys, where:

- The receiving attorney drafts official demand letters on their law firm’s letterhead, demanding payment of the debt owed.

- The attorney or their staff members initiate contact with the debtor via telephone, in addition to sending a series of letters.

- DCI keeps clients informed about the case’s status and provides recommendations for further action.

Phase Three: Informed Decisions

DCI’s recommendation in this phase depends on the case’s viability:

- If, after a thorough investigation, recovery seems unlikely, DCI recommends closing the case. Clients owe nothing in such instances.

- If litigation appears to be the best course of action, clients have a choice. They can proceed with legal action, covering upfront legal costs. If litigation efforts fail, no fees are charged.

Competitive Rates

Flexible, Industry-Best Rates

DCI’s rates are widely recognized as industry-best and are open to negotiation. Clients submitting multiple claims within the first week can explore customized contingency fee options by contacting 855-930-4343.

A Strong Recommendation

Prioritizing DCI for Debt Recovery

In conclusion, considering DCI’s expertise, effective debt recovery system, competitive rates, and commitment to a “No Recovery No Fee” policy, businesses involved in the Electronics Manufacturing sector within the U.S.A. and South Korea International Corporate Marketplace are strongly encouraged to explore DCI’s third-party debt recovery services before considering litigation or attorney involvement.

Contact DCI

To learn more about how DCI can safeguard your Accounts Receivable Portfolio in international trade, visit www.debtcollectorsinternational.com or call 855-930-4343.